special tax notice voya

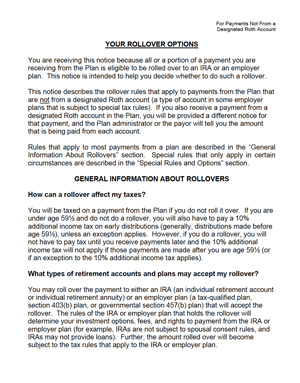

A notice describing the circumstances under which your account may be invested in a qualified default investment alternative QDIA. You are receivingthis notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA.

Amazon Com The Passive Programming Playbook 101 Ways To Get Library Customers Off The Sidelines 9781440870569 Willey Books

Trs members of applicant the special tax.

. This Notice describes the rollover rules that apply to payments from the Savings Plan that are from a designot nated. Voya Retirement Insurance and Annuity Company VRIAC Voya Institutional Plan Services LLC VIPS Members of the Voya family of companies PO Box 990063 Hartford CT 06199-0063. PAGE 2 RETIREMENT PLAN DISTRIBUTIONS.

In addition special rules apply when you do a rollover as described below. Account with special tax rules in some employer plans. The IRS requires an employer to provide a notice to all employees eligilble to participate in the 403 b plan at least once annually about the opportunity to.

Special Tax Notice prior to requesting a withdrawal and you may be asked to acknowledge that you have. This to active directory login to the special tax information notice voya. Special Tax Notice.

Account with special tax rules in some employer plans. You are receiving this notice in the event that all or a portion of a payment you are receiving from. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account a type of account in some employer plans that is subject to special.

Call and speak to. If you also receive a payment from a designated Roth account in the Plan you will be provided a different notice for that payment. Voya Target Solution Trust Fund Fact.

Your Rollover Options for Payments from a Designated Roth Account. Your Plan Administrator because all or a portion of a. Special Tax Notice Notice Regarding Plan Payments- Your Rollover Options This Notice is provided to you by Nestlé USA Inc.

The Internal Revenue Code provides several complex rules relating to the taxation of the amount you may receive as a. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account a type of account in some employer plans that is subject to special. Account a special rule may apply to determine whether the after-tax contributions are included in a payment.

This Notice is intended to help you decide whether to do such a rollover. Voya Customer Service Associate at 800 584-6001. If you also receive a payment from a designated Roth account in the Plan you will be provided a different notice for that payment.

Retire Plan Save Retire Myfloridacfo

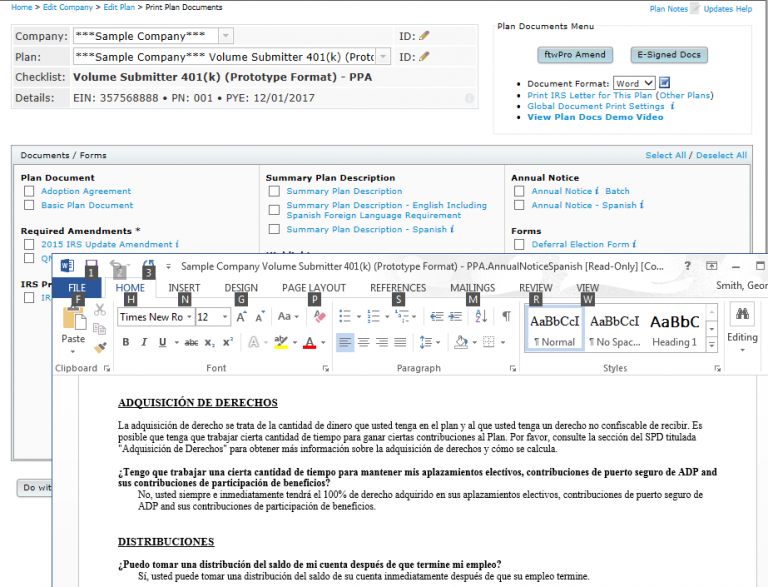

Retirement Plan Documents Ftwilliam Com Wolters Kluwer

Deferred Compensation Complete Details Multnomah County

Amazon Com The Ice Dragon 8601421562133 Martin George R R Royo Luis Books

Participant Distributions Aba Retirement Funds

In Service Withdrawals Aba Retirement Funds

Think Your Retirement Plan Is Bad Talk To A Teacher The New York Times

Voya To Make Its Permanent Metro Phoenix Home In Chandler

Amazon Com Emergency Room 9781504035545 Cooney Caroline B Books

Deferred Compensation Multnomah County

Adp Totalsource Retirement Savings Plan

401k And Non 401k Hardship Withdrawals Aba Retirement Funds

401k And Non 401k Hardship Withdrawals Aba Retirement Funds

Retire Plan Save Retire Myfloridacfo

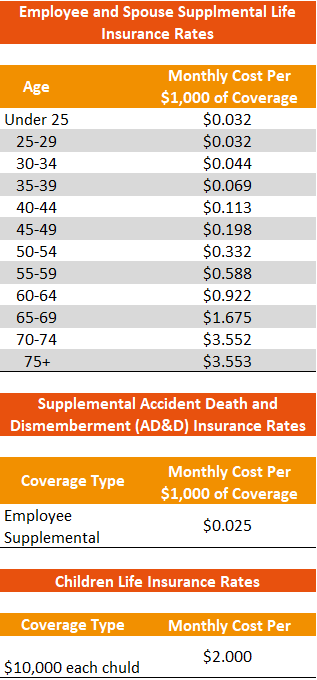

City Of Alameda Employee Benefits

Ex Voya Client Seeks To Vacate Finra Arbitration Award Financial Planning